Also known as the general ledger, the ledger is a book in which all accounts relating to a business enterprise are kept. Now, any business with a full-time bookkeeper is likely to use computerized accounting. In the past, these records would literally have been kept in bound ledger books. However, the business owner can easily find the total purchases amount from the purchases account. When you hire a bookkeeper who understands your industry, they’re able to set up your books using sub-ledgers that make sense for you. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington.

List of General Ledger Accounts and Content

A sales ledger is a detailed list in chronological order of all sales made. This ledger is often also used to keep track of items that reduce the number of total sales, such as returns and outstanding amounts still owed. A tech savvy accounting and bookkeeping firm serving small and midsized businesses, we focus on building scalable accounting department for our clients.

Classification of General Ledgers

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. We will also need to make an entry of $4,000 on the credit side of the furniture account because the liability to this creditor is increasing. An important point to note is that the treatment for assets is exactly the opposite of the treatment for liabilities and capital. Whenever an amount of cash is paid out, an entry is made on the credit side of this account. Transactions result in an increase or decrease in the value of various individual balance sheet items. If the totals of the two sides of the account are equal, the balance will be zero.

An Income Statement Transaction Example

For each account, the general ledger shows the account balance at the beginning of the period, all credits and debits that hit the account during the period, and the ending balance. If you’re looking for a better way to track general ledger activity, be sure to check out the applications above, or check out The Ascent’s accounting software reviews to view even more options. While this is just a partial list, remember that any transaction made by your business will always affect your general ledger accounts accordingly. If you run a general ledger report from January 1, 2020 through February 29th, 2020, you will have beginning and ending balances readily displayed for both January and February. These are typically recorded in the general ledger as they are incurred. Your general ledger might break these down into accounts for rent, merchant fees, software subscriptions, telephone and internet, cleaning, and so on.

- Accounts receivable (AR) refers to money that is owed to a company by its customers.

- The set of 3-financial statements is the backbone of accounting, as discussed in our Accounting Fundamentals Course.

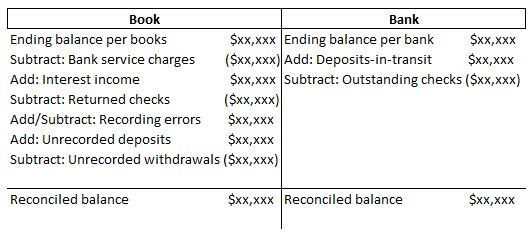

- This is done by comparing balances appearing on the Ledger Accounts to the original documents like bank statements, invoices, credit card statements, purchase receipts, etc.

- General Ledger is a principal book that records all the accounts of your company.

- This data from the trial balance is then used to create the company’s financial statements, such as its balance sheet, income statement, statement of cash flows, and other financial reports.

What Is General Ledger Accounting?

General Ledger Codes are nothing but the numeric codes that you assign to different https://www.business-accounting.net/s. These accounts help you in organizing the General Ledger Accounts properly and recording transactions quickly. This is because you or accounting professionals are no longer required to go through the pain of recording the transactions first in the Journal and then transfer them to Ledger. Furthermore, a General Ledger helps you to know the overall profitability and financial health of your business entity. In addition to this, the detailed information contained in General Ledgers helps you to do the audit smoothly.

How confident are you in your long term financial plan?

The main record of your business’s financial standing is an accounting ledger. Also commonly referred to as a general ledger, it is the repository of all of your financial transactions. For instance, cash activity https://www.kelleysbookkeeping.com/what-is-cross-foot/ is usually recorded in the cash receipts journal. The account details can then be posted to the cash subsidiary ledger for management to analyze before it gets posted to the general ledger for reporting purposes.

Accordingly, law firms must be able to maintain their general ledgers and perform all the accounting functions that go along with them. Some of these accounts are balance sheet accounts and some are income statement accounts. Thus, as per the above table, the credit sales figure of $200,000 would go into the accounts receivable control account. Whereas, the sales details of various debtors like Jack & Co., Mayers, and John can be found in the related subsidiary ledger. A General Ledger is a Ledger that contains all the ledger accounts other than sales and purchases accounts. Therefore, you need to prepare various sub-ledgers providing the requisite details to prepare a single ledger termed as General Ledger.

The only difference is that the balance is ascertained after each entry and is written in the debit or credit column of the account. In the standard format of a ledger account, the balance is not stated after each transaction. This is why this type of account is also called the periodical balance format of a ledger account.

In accounting, a General Ledger (GL) is a record of all past transactions of a company, organized by accounts. General Ledger (GL) accounts contain all debit and credit transactions affecting them. In addition, they include detailed information about each transaction, such as the date, description, amount, and may also include some descriptive information on what the transaction was. A quick history lesson can help explain the difference between a journal and a ledger. While the way you record transactions has changed, the importance of the general ledger remains.

This is because the journal contains a large number of transactions relating to purchases at different places according to their respective dates of occurrence. It’s available to download in Google Docs, Google Sheets, XLS, DOC, and PDF, making it easier to see your business finances at a glance. Using a GL will keep you up-to-date on your cash flow, debts, and spending, so you can watch for trends and make adjustments to your business operations to maximize profits over time.

Law firms have an especially heightened interest in this area due to their use of trust accounts. Legal practices often hold client funds in trust accounts, such as for retainer fee payments or settlement funds. Most U.S. jurisdictions have bar rules governing maintenance and reconciliation high low method calculate variable cost per unit and fixed cost of client trust accounts. Double-entry bookkeeping ensures the business maintains accurate records with a corresponding relationship between each liability and asset. For instance, if you were recording an asset, the sub-accounts might include savings, inventory or accounts receivable.

Speaking of record keeping of transactions, we will take a slight detour here to look at GL codes. Expenses consist of money paid by the business in exchange for a product or service. I don’t pay for much with checks anymore, but when I do write one to pay rent every month, I always write down the check number and the amount in the little paper ledger at the front of my checkbook. FreshBooks offers smaller businesses a great way to manage their general ledger. FreshBooks currently offers four plan options, making it easy to transition to a more powerful plan. FreshBooks is designed for easy navigation, so even new users can easily find their way around.

Misclassified transactions can be especially difficult to detect, as debits and credits will typically still remain in balance even with these mistakes. It is used to track revenue and expenses, as well as provide the status of the company’s financial health. The general ledger is also essential to generate all of the company’s financial reports and statements, in addition to tax compliance. Adjusting Entries are the entries prepared at the end of the accounting period to consider income or expenses that you have not yet recorded in the General Ledger.

From recording every financial transaction to identifying potential pitfalls, it has a solution you need to know. With an expense Ledger, you get a transparent picture of where exactly your money is going. That is because an expense ledger exclusively focuses on keeping a robust record of all the costs incurred by your business.

Debits to the account appear on the right, and credits to the account appear on the left. The general ledger is an essential part of your accounting and bookkeeping processes. The general ledger serves as a repository for every transaction that is recorded, and is a must for any business using double-entry accounting. Some companies use sheet software like Excel for this purpose, but it’s typically not efficient for bookkeeping. Instead, accounting software solves this because automation brings efficiency and simplicity to the process.